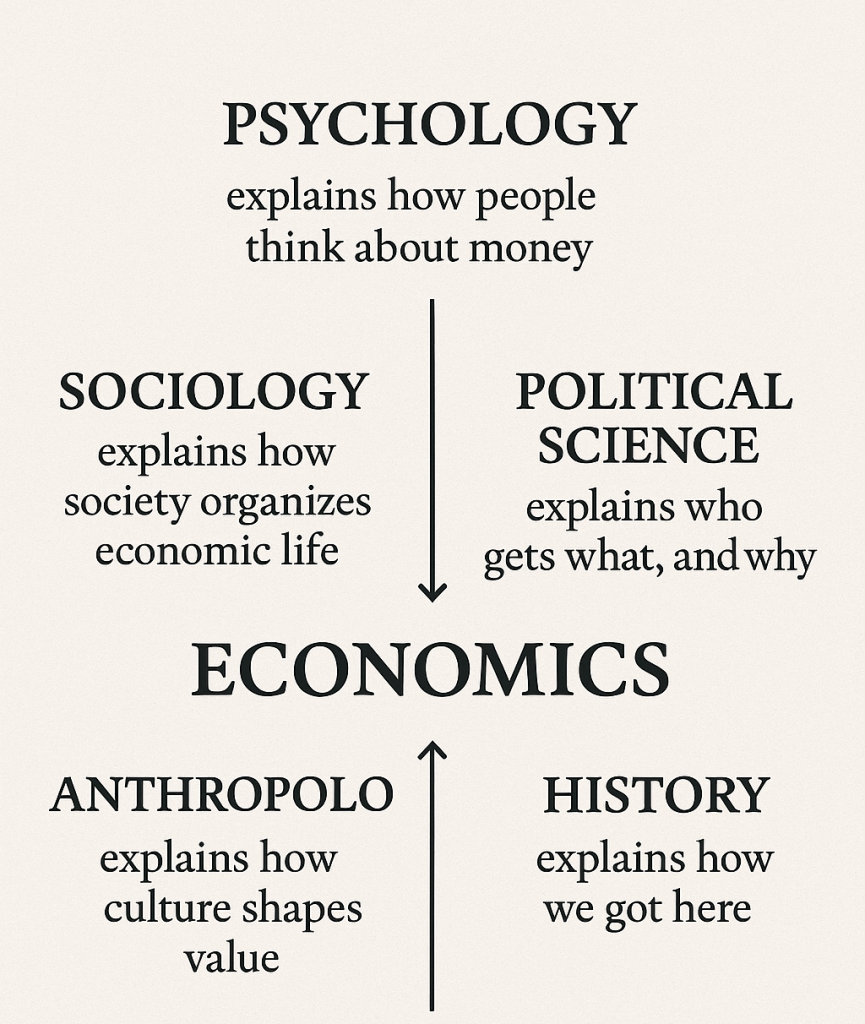

Economics is often mistaken for a branch of mathematics, a field of graphs, equations, and perfect curves. But the truth is, economics is a human science before it is a numerical one. It deals not only with markets but with minds; not just with prices but with people.

Psychology explains why consumers buy what they don’t need, why fear drives markets down, and greed sends them soaring. Sociology shows how culture, family, and class affect spending and saving. Political science reminds us that every economic system is shaped by power and policy, not just supply and demand. History warns that even geniuses fall victim to human folly, just as Isaac Newton, the father of modern physics, lost a fortune in the South Sea Bubble, proving that even the world’s greatest mathematician could not calculate human emotion.

If economics were only about formulas, then AI would have already mopped all the money from the market. Machines can process data, but they can’t feel trust, panic, or euphoria, the real forces that move economies. Without having command over psychology, sociology, politics, and history, one can never understand true economics. The heart of economics lies not in numbers, but in human nature, unpredictable, emotional, and beautifully irrational.

The same happened in 2008, when top bankers with PhDs in mathematics and economics failed to predict a global financial meltdown because their models ignored panic, trust, and greed. John Maynard Keynes, the father of modern macroeconomics, once said, “Markets can stay irrational longer than you can stay solvent.” That irrationality is not in the numbers, it’s in us. The Tulip Mania of 17th-century Holland, when people sold homes for flowers, and the Dot-com bubble, when investors bet fortunes on dreams, show that emotion rules finance more than logic.

Without having command over psychology, sociology, politics, and history, one can never understand true economics. The heart of economics lies not in numbers, but in human nature, unpredictable, emotional, and beautifully irrational.